Choosing Between Medicare Advantage And Medicare Supplement: What’s Covered?

Medicare

Picking a health plan is a big decision, which is why it’s important to carefully weigh your options when choosing a Medicare plan. Original Medicare, which includes Part A and Part B, covers many expenses, but beneficiaries still end up being responsible for certain copayments and deductibles. Original Medicare also does not provide coverage for dental, vision, or prescription drugs. Over time, these out-of-pocket expenses add up. This is why many people turn to Medicare Advantage, or Medicare Supplement plans to curtail the costs not covered by Original Medicare.

You can’t have both a Medicare Advantage and a Medicare Supplement plan – you have to choose one or the other. There are significant differences between these two types of plans in terms of how they work, benefits, and costs. Medicare Advantage and Medicare Supplement plans have pros and cons, and understanding how a plan can meet your unique health needs is crucial to making the right choice. Here are some tips that can help you choose the plan that’s best for you.

Medicare Advantage Plans

Medicare Advantage plans are offered by private insurance companies and provide coverage for both hospital and medical insurance. These plans serve as an alternative to Medicare Part’s A (hospital insurance) and B (medical insurance). Most Medicare Advantage plans also include drug coverage (Part D). Medicare Advantage plans must provide the same level of coverage as Original Medicare, though some plans also cover additional benefits not included in Original Medicare, such as vision, dental, and prescriptions.

Be sure to check if Part D benefits are included in a Medicare Advantage plan. If these benefits aren’t included, you’ll need to buy a Part D plan for coverage. If this is the case, you will also need to calculate the cost of premiums and copays for Part D. Also, be sure to check if the plan covers the medications you take.

Medicare Advantage Premiums

Some Medicare Advantage plans have a $0 premium, which means you don’t have to pay additional premiums for the plan itself (you still pay your part B premium). However, low premiums may come with some inconvenience. When enrolled in a Medicare Advantage plan, you must use the plan’s network of providers to get care, which can limit your options for care. If you’re thinking of changing to a Medicare Advantage plan, check with your doctors to see if they will still be in-network. Since your care is limited to in-network providers, the quality and size of a plan’s network should be focal considerations in your choice.

When Medicare Advantage plans do let members get care out of network, the cost for care can skyrocket. This can be an issue if you travel a lot and need care while away from your network of providers. Some plans also require preauthorization for specialty care or a referral from a primary provider, which can be inconvenient.

Medicare Advantage Copays

Another cost to consider with Medicare Advantage plans is copays, which vary with each plan. Copays can add up if you see your provider often, so keep this in mind when selecting a plan. Additionally, Medicare Advantage plans also have annual out-of-pocket maximums, which are federally capped at $7,550 per year in 2021. Though not all plans have this maximum, this can be a high cost for people on fixed incomes.

Medicare Supplement Plans

Medicare Supplement, also known as Medigap, is insurance that helps fill the gaps in Original Medicare. Medigap is sold by private companies and can help cover costs like copayments, coinsurance, and deductibles. Certain Medigap policies cover services not covered by Original Medicare, such as care when you travel internationally.

Medigap kicks in after Medicare pays its share of covered health costs. To use Medigap, you must be enrolled in Original Medicare. Beneficiaries must pay a monthly premium for a Medigap policy in addition to the Part B premium paid to Medicare. Additionally, Medigap plans sold after January 1, 2006, aren’t allowed to provide prescription drug coverage, so you will need to get prescription coverage; this is a cost to consider. Be sure to calculate the cost of Part D, in addition to Part B and Medigap costs, to get a better idea of your overall costs.

Medigap plans can offer a lot of flexibility when it comes to receiving care. You can see any provider nationally who accepts Medicare without a referral, even for specialty providers. This amounts to over 900,000 doctors and hospitals, which is convenient for beneficiaries who travel often. However, more flexibility means higher premiums than Medicare Advantage plans.

Additionally, you don’t have to pay any deductibles with Medigap, which might make it easier to predict your costs. Medigap plans may also cover foreign travel emergencies, extra days in the hospital, and coinsurance costs you otherwise have to pay. Supplemental plans can offer a larger safety net in emergencies.

Factors to Consider

With a lot of information and factors to consider, asking yourself some questions about your lifestyle and healthcare needs might help you decide between Medicare Advantage and Medigap.

Here are some points to consider:

Deductibles (if any)

Monthly premiums

Projected cost of healthcare services on each plan

Areas where you will need care

How often do you use healthcare services

Copays for medications

Potential out-of-pocket expenses for each plan

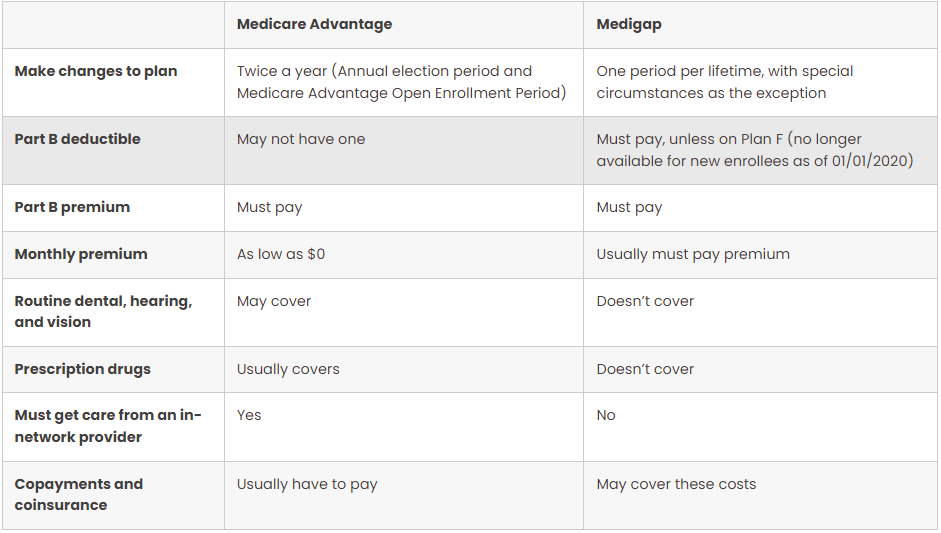

Here is a chart that can help you compare between these options: